Algumas criptomoedas, como Bitcoin e Ethereum, têm várias aplicações e valor real no mundo.

Não perca seu tempo. Acompanhe o impacto das NFP no dólar dos EUA!

Aviso de coleta de dados

Nós mantemos um registo dos seus dados para fazer funcionar este sítio web. Ao clicar no botão, concorda com a nossa Política de Privacidade.

Livro de Forex para principiantes

O seu grande guia no mundo do trading.

Confira a sua caixa de entrada!

Encontrará no nosso e-mail o Livro Básico de Forex. Basta tocar no botão para obtê-lo!

Alerta de risco: ᏟᖴᎠs são instrumentos complexos e vêm com um alto risco de perda rápida do dinheiro devido à alavancagem.

71,43% das contas de investidores de retalho perdem dinheiro ao negociar ᏟᖴᎠs com este provedor.

Deve considerar se entende como funcionam os ᏟᖴᎠs e se tem condições de assumir o alto risco de perder o seu dinheiro.

Informação não é consultoria em investimentos

Hey, have you heard about the latest news on de-dollarization? It's the process of shifting away from the US Dollar (USD) as the world's reserve currency for trading oil and other commodities. The USD has been facing many problems lately, such as rising inflation, declining geopolitical relations, and the erosion of trust in banks and the Federal Reserve. As a result, many countries are moving towards using their currencies instead. For instance, China has already signed agreements with Australia, Russia, Japan, Brazil, and Iran to use their national currencies for trade. Moreover, the BRICS member countries are discussing the possibility of creating their currency backed not by gold but by land and rare earth metals. This could significantly weaken the USD's presence in global economic activity and boost cryptocurrencies like Bitcoin. Exciting times are ahead for global currencies, don't you think?

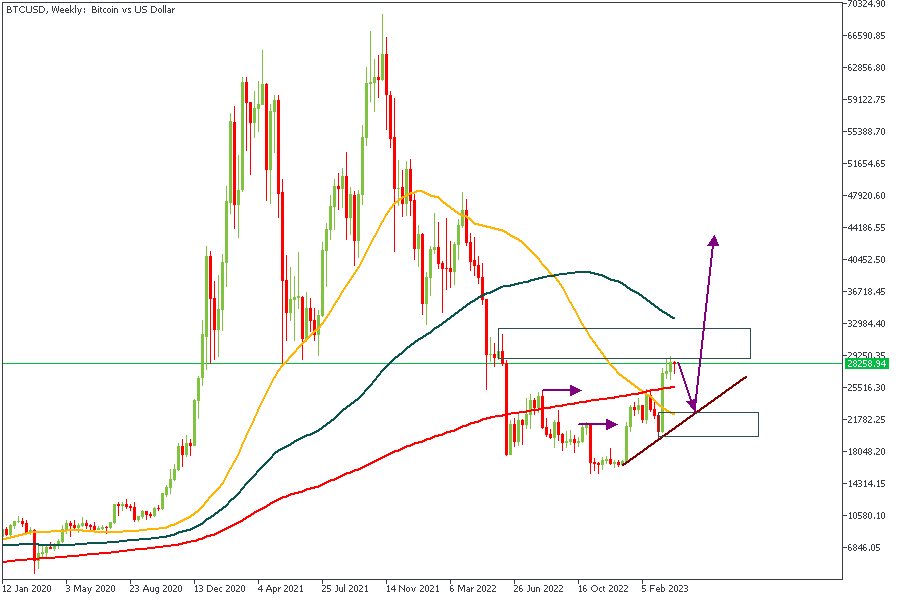

The weekly timeframe of BTCUSD is currently at a drop-base-drop supply zone. It is expected that we will get to see some minor initial reactions from the supply zone. The overall market direction, however, looks largely bullish based on the break above the previously marked highs. The trendline support and the 100-period moving average are in perfect alignment. Combining that with the drop-base-rally demand zone, we have credible confirmations of the bullish sentiment.

Analysts’ Expectations:

Direction: Bullish

Target: $37124

Invalidation: $19506

Based on the technical breakdown indicating a change in the market from a bearish to a bullish sentiment, it is safe to conclude that the Bulls might just be gearing up to resume the bullish movement once the retracement move is completed.

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

Legal disclaimer: The content of this material is a marketing communication, and not independent investment advice or research. The material is provided as general market information and/or market commentary. Nothing in this material is or should be considered to be legal, financial, investment or other advice on which reliance should be placed. No opinion included in the material constitutes a recommendation by Tradestone Ltd or the author that any particular investment security, transaction or investment strategy is suitable for any specific person. All information is indicative and subject to change without notice and may be out of date at any given time. Neither Tradestone Ltd nor the author of this material shall be responsible for any loss you may incur, either directly or indirectly, arising from any investment based on any information contained herein. You should always seek independent advice suitable to your needs.

Algumas criptomoedas, como Bitcoin e Ethereum, têm várias aplicações e valor real no mundo.

A pandemia continua a prejudicar a atividade económica na China, a guerra na Ucrânia continua a impactar a economia europeia inteira, e os esforços do Federal Reserve para controlar a inflação ameaçam provocar uma recessão.

Sempre que a inflação excede 4% e o desemprego vai abaixo de 5%, a economia dos EUA entra em recessão dentro de dois anos.

BCE dovish e Fed hawkish pintam uma paisagem pessimista para o EUR/USD. Será a próxima parada uma queda a 1,0770?

Seu pedido foi aceito

Faremos contacto no intervalo de horário escolhido

O próximo pedido de contato para este número de telefone estará disponível em 00:30:00

Se tiver um problema urgente, por favor, contacte-nos via

Chat ao vivo

Erro interno. Por favor, tente novamente mais tarde