First steps of a trader. Where to start your Forex journey?

Information is not investment advice.

Welcome to the world of trading! You probably want to become more active in managing your finance and are now in doubts where to start. This article will guide you through the basics of Forex and show which steps you should take on the way to becoming a professional. Ready? Then let’s get started!

Step 1. Open an account

The first step that every trader should make is to open an account. If you are a newbie, open a demo account first. It will give you a great opportunity to try yourself in Forex trading without any risks, as you will use virtual (not real) money. Even if you make a mistake, you won’t lose anything. Take your time! When you understand how to trade, you can easily open a real account in your personal area and invest real money in trading.

Here are some tips for trading on a demo account:

- Choose the same capital as the one you will have on a real account.

- Try to imagine that the virtual money is real and profits and losses are real too.

- Remember that if you fail to profit on a demo account, you will not be able to earn it on the real one, so practice and learn more and try to grasp the key elements of trading while using the demo account.

If you already have some knowledge about trading and you are confident in your skills, you may open a cent account where the initial deposit starts from 10 euro or equivalent in US dollars. On standard accounts deposit start from 100 euro or the USD equivalent.

Step 2. Get the trading software

When you open an account and verify your personal area, you get the opportunity to deposit, manage, and withdraw your money. To make the actual trades, you will need a special software. FBS provides all the necessary programs free. You can choose between several options:

- MetaTrader 4: a classic solution for Forex traders. It has everything one requires for making a trade decision.

- MetaTrader 5: a trading terminal with a wider range of technical indicators, timeframes and other options for in-depth market analysis. Both MT4 and MT5 have versions for Windows and Mac as well as for Android and iOS mobile platforms.

- FBS Trader: an all-in-one trading platform app with simple interface, instant deposits and withdrawals and 24/7 support.

Choose a software you like best or combine all of them: it’s up to you. Once you have downloaded a trading platform, log in using the account number and the password you got during the registration. This will connect you to FBS servers. You will get live quotes of the currency pairs, commodities, and indexes. Have you followed these steps? If yes, congratulations! You are now able to open trades. But which ones?

Step 3. Grasp the basic concepts

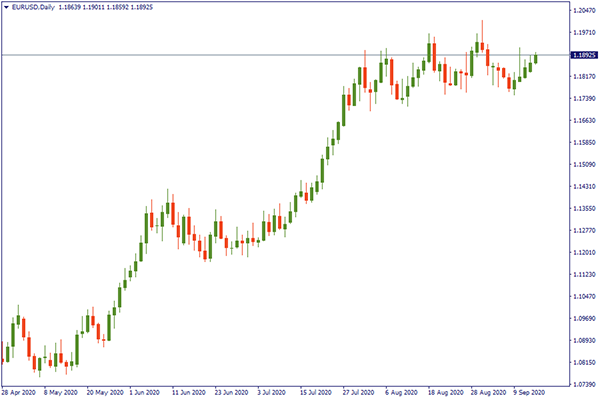

The main idea of trading is that you buy when you expect the price of an asset to go up and sell if you think that it will go down. Currencies form pairs because to estimate the value of one currency we need to quote it versus another one. The most popular Forex pairs are EUR/USD, GBP/USD, USD/JPY, and AUD/USD. You can also trade commodities such as gold (XAU/USD) and crude oil (Brent and WTI), as well as indices (DAX 30, S&P 500, etc.).

The prices of all these assets move up and down because of various economic reasons. You will discover that the performance of global economy and the economies of the key nations have a huge impact on the currency market. Other factors, for example, the coronavirus pandemic also bring financial markets in motion. As a result, if you know what is happening in an economic world, you will be able to make a well-reasoned trade decision. To learn about all market-moving events and chart analysis, check educational materials and attend webinars organized by FBS.

Step 4. Learn the math

The next step is to get familiar with some key trading terms and calculations.

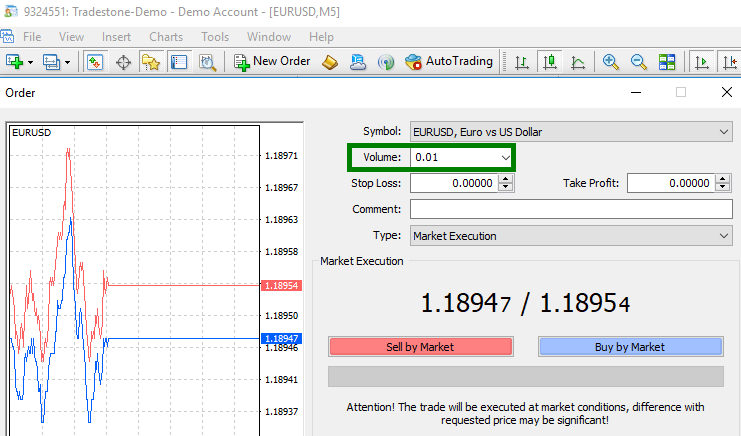

Once you decided which instrument to trade and what to do – buy or sell – you need to choose how much money to spend on this trade. In particular, when you open a new trading order in a trading software, you need to choose a volume of your trade. This parameter is measured in lots.

A lot is a number of currency units. A standard lot (trade volume of “1.0” in a trading terminal) is equal to 100 000 units of a base currency (the currency that stands at the first place in a pair).

It means that if you want to trade 1 lot of EUR/USD without leverage, you will need 100 000 euro. Notice that the smallest position size on Forex is 0.01 (in this case, 1 000 euro).

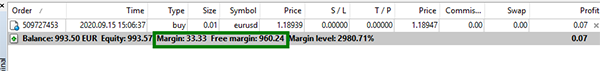

Leverage allows you to trade with more money than you have on your account. Let’s say, you have the leverage of 1:20. It means that you will need to provide only a twentieth of the desired trade size. The remaining 95% will be added by FBS to make your trade work. In other words, with 1:20 leverage you will need 50 euro to trade 1000 euro. This sum – 50 euro – is called margin: this is the money a broker “freezes” out of your account to finance the trade. Free margin shows the amount you can use on other trades.

Leverages available to retail Forex traders are 1:20 and 1:30 depending on a currency pair. Traders who have the category “professional” are entitled to a 1:500 leverage.

If we go with the example above, 50 euro is 5% of 1 000 euro, so it fits the rule. What can you do with 50 euros on Forex? How much can you earn?

When you trade, your profit or loss depends on how many points the price went in your favor (i.e. up if you had a buy trade or down if you opened a sell order) or against you.

A point is the smallest change a price can make. Usually, a currency pair is quoted to five decimal points. For example, if EUR/USD changes from 1.08000 to 1.08005, it’s a change of 5 points. However, there are some pairs that have 3 decimal points. For example, if USD/JPY changes from 120.000 to 120.013, it’s a change of 13 points.

Imagine you bought EUR/USD 1.15000, the pair went up and you closed your position at 1.15500. As a result, you earned 500 points.

If the volume of you trade was 0.01, these points will bring you 1 000*0.00001/1.15500*500 = 4.3 euro.

This is the logic of Forex calculations for you to understand how everything works. To save your time, FBS has prepared trader’s calculator that will help you do the entire math in no time.

Step 5. Manage your risk and practice

They say that practice makes perfect. There’s a lot of merit in this saying. Yet, in trading, there’s no such thing as perfection. Before you start, you need to understand that no person can predict the future and thus no trader can avoid occasional losses. The goal of a trader is to achieve a decent number of good trades (they do that by analyzing the market and improving their technical strategies) and then maximize the outcome of those trades by the rational management of funds and risks.

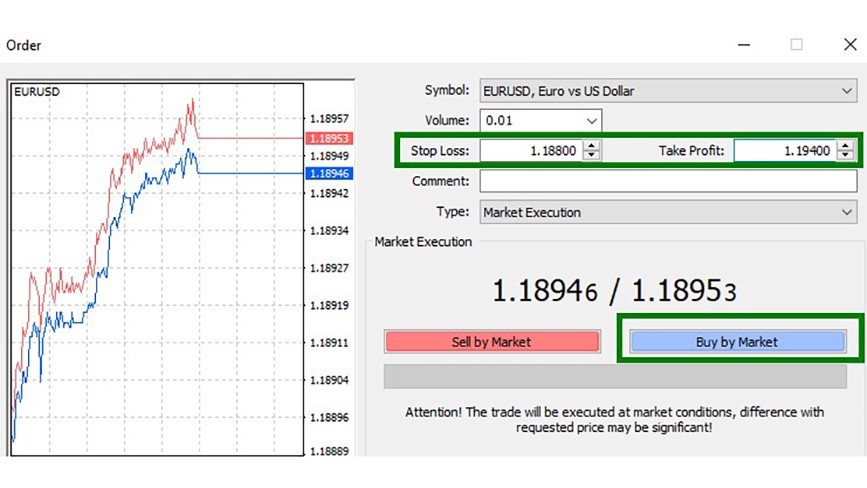

Indeed, trading is risky. Be aware, that leverage increases not only the potential profit, but also chances of failure. To limit loses and fix good results, you can use Stop Loses and Take Profits. These orders will close your trade when the price reaches the levels you choose. With Stop Loss you will cut possible loss down to a number of points you can afford to risk. Take Profit will lock your gains. It’s recommended to set Take Profits that exceed Stop Losses. This way one good trade will bring you more than you will risk losing in a bad trade.

Finally, you will learn the most from your own experience. Follow the tips above, manage your risks and practice more – this is the correct approach to trading.

That’s it! You have made a huge progress today. Keep learning and good luck in your Forex journey!