Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Join Us on Facebook

Stay on top of company updates, trading news, and so much more!

Thanks, I already follow your page!

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

72.12% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

2019-11-11 • Updated

Information is not investment advice

Do you know that opportunities to earn money are not limited by trading your favorite EUR/USD, GBP/USD and USD/JPY? Furthermore, a currency pair may be formed without the US dollar? In this article, we are going to introduce you to the so-called "currency cross pair". You will find out the special features of these pairs and learn how to trade them and to avoid mistakes.

What is a currency cross pair?

After World War II ended and the gold standard crashed, most currencies were quoted against the US dollar, which was fixed to gold. When a person wanted to exchange a sum of money into a different currency, he needed to convert that money to the USD and then convert it into the desired currency. Luckily, the currency cross pairs were invented. They allow to bypass the process of converting currency into the US dollars instead you convert it to the desired currency straight away.

Generally speaking, a currency cross pair (cross currency, cross) is a pair of currencies in the Forex market, which does not include the USD.

With FBS, you can trade AUD/CAD, EUR/GBP, CHF/JPY, EUR/NZD, and even more cross pairs!

How currency cross rates are calculated?

It's important to understand how these types of pair are created.

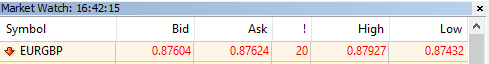

Let’s consider the EUR/GBP pair. We need to look at the bid/ask price for GBP/USD and EUR/USD to calculate the bid price for EUR/GBP.

Why do we choose these pairs? That is because they have the USD as the quote currency in them.

GBP/USD: 1.2887 (bid) / 1.2889 (ask)

EUR/USD: 1.1286 (bid) / 1.1287 (ask)

To calculate the bid rate for EUR/GBP we need to divide the base currency bid by the quote currency ask:

EUR/GBP (bid) = 1.1286/1.2889 = 0.8756

For the ask rate, we need to divide the base currency ask by the quote currency bid.

EUR/GBP (ask) = 1.1287/1.2887= 0.8758

Seems tough? Most brokers, including FBS, calculate the cross rates and the size of the spread for you automatically. Thus, you don’t need to learn the formula above. Yay!

What currency cross pairs you may choose?

Cross currency pairs may be divided into three groups.

First group – cross pairs with commonly traded majors (the EUR, the JPY, and the GBP). They have good liquidity, which may be compared to the major currency pairs. It shows that many traders trade them and the chances of an unexpected jump of the price are low. You can trade, for example, EUR/GBP, GBP/JPY, CHF/JPY.

The second group combines so-called “obscure” currency crosses as very few traders trade them. They don’t have the EUR, the JPY or the GBP in them. This fact makes the movements of their price extremely volatile. Let’s look at the chart of NZD/CAD. We can see the long bullish and bearish candlesticks. These big spikes create an additional challenge for traders while determining the next movement of the price. You need to be careful while trading them and do a proper analysis.

Finally, there are exotic cross currency pairs. They have an emerging market currency in them. With FBS you can trade such exotic crosses as CHN/JPY, EUR/TRY, and EUR/CNH. As with the second group, you need to be careful while trading them and don’t forget to use stop losses.

Why do you need to trade the currency cross pairs?

On the picture below the weaker releases for the US dollar and the positive news for the EUR shows the equal balance of powers between bulls and bears and makes the pair trade sideways. As a result, it is harder to determine and follow the current trend.

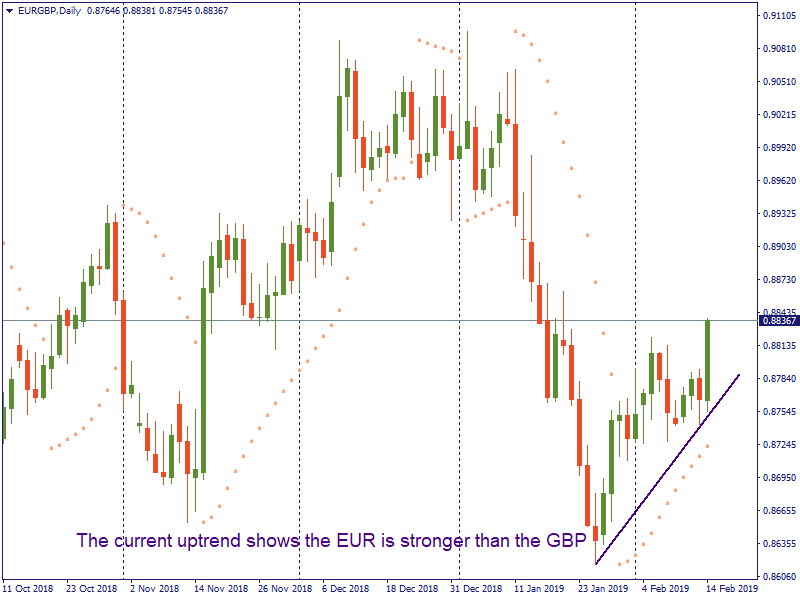

Now let’s look at the EUR/GBP chart. We know that the British economy struggles amid the Brexit uncertainties. That is why the EUR is stronger than the GBP. We see that the uptrend for the pair here is easier to determine, as the EUR pushes the pair higher. That is why we can take advantage of the strong release for the Eurozone.

You can earn money by selling currencies with a lower interest rate against currencies whose country has a higher interest rate. This strategy is known as a carry trade strategy.

Currency crosses can help you to identify the relative strength of each major currency pair.

Imagine, that you see the buy signal for both EUR/USD and GBP/USD, but you can trade only one currency pair. The analysis of EUR/GBP cross will help you to choose the perfect one for a long position. If the trend for the pair is bullish, it shows that the EUR is relatively stronger than the GBP at the moment. So you need to buy EUR/USD instead of GBP/USD.

Since the GBP is weaker than the EUR, if it strengthens against the USD, it will strengthen less than the euro. As a result, EUR/USD would rise more extensive than the British pound when the USD weakens.

Example

On the charts of EUR/USD and GBP/USD below, we noticed that MACD formed a bullish divergence, which may be a good signal to buy. But we need to choose only one pair.

We decide to check EUR/GBP for other clues. The pair is moving upwards. That means that the EUR is stronger than the British pound. If the currency strengthens, you would make more pips while trading EUR/USD, than GBP/USD.

Conclusion

Now you see that trading cross currency pairs is not just a way for a trader to look more “hipsterish”. They help you to fully understand any moves in the market, provide you with an opportunity to trade the currencies directly against each other and offers you more chances to earn money.

Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Trend strategies are good - they may give significantly good results in any time frame and with any assets. The main idea of the ADX Trend-Based strategy is to try to catch the beginning of the trend.

Counter-trend strategies are always the most dangerous but also the most profitable. We are pleased to present an excellent counter-trend strategy for working in any market and with any assets.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later