Happy Tuesday, dear traders! Here’s what we follow:

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Join Us on Facebook

Stay on top of company updates, trading news, and so much more!

Thanks, I already follow your page!

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

72.12% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Risk-averse still prevails on the market. Safe-haven assets are in favor, while risk-off ones are left aside. Great opportunities to make profit!

Let’s start with the most important pair. It has been falling down for two sessions straight as the market turned to risk-off after the Fed’s pessimistic prospect for the future recovery. However, today it went upward. Most analysts think that this was just a short correction and EUR will continue dipping. Indeed, fears of the second pandemic wave can add on demand for the safe-haven US dollar as Japan, China, and the US have reported a jump in the coronavirus cases. A bearish case will be firmer once EUR/USD breaks down the support level at 1.1170 or 61.8% Fibonacci level. After that, it may drop even deeper to the next support at 1.1065. Anyway, if some positive factors push EUR up, it will meet the resistance at 1.1310 or 78.6% Fibonacci level. Keep an eye on the EU trade balance that will be released today at 12:00 MT time.

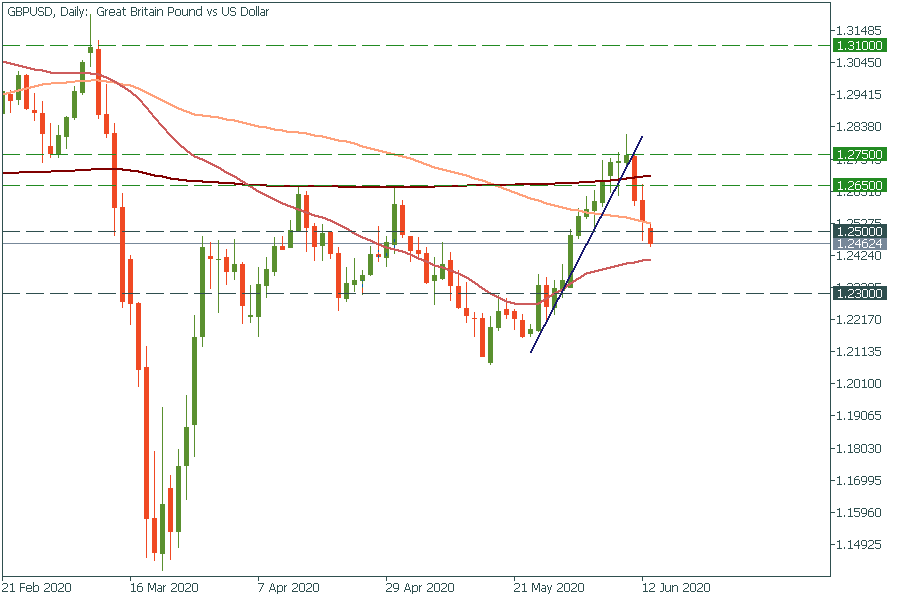

A broad risk aversion wave pushed the British pound down. Moreover, on Friday the UK GDP turned out worse than analysts expected: -20.4% vs -18.6. According to The Times, the Bank of England will unleash further 150 billion pounds of stimulus in its latest effort to mitigate the economic damage from COVID-19. What’s more important, today’s Brexit negotiations will shed light on the fate of the UK economic future. If talks give hopes for the upcoming trade deal, it may push GBP higher. Otherwise, any delay on the agreement will cause looses for the British pound. On the GBP/USD chart we can notice that the pair has crossed the support level at 1.25. Now it’s headed towards the next support at 1.23. Resistance levels are 1.265 and 1.275.

Resurgence in coronavirus cases all over the world and the fresh outbreak in China make investors worry about the second wave of infections and the rebound of the oil demand, as well. According to ING Economics:

“the recovery in oil demand is already set to be a lengthy process, and a fresh wave of cases will certainly raise worries that a recovery in demand may take even longer than initially thought”.

On Thursday OPEC+ will discuss current output cuts and see whether all the countries have followed the agreement to reduce the oil supply. The WTI oil price is headed towards the support at $34, where also the 100-day moving average goes. If it crosses it, the price may slump to $30 a barrel. The resistance level is at $40.

To trade WTI with FBS you need to choose WTI-20N.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later