A Agência Australiana de Estatística vai anunciar os novos resultados da taxa de desemprego e da criação de empregos, na quinta-feira, 19 de maio, às 04:30 (MT).

Não perca seu tempo. Acompanhe o impacto das NFP no dólar dos EUA!

Aviso de coleta de dados

Nós mantemos um registo dos seus dados para fazer funcionar este sítio web. Ao clicar no botão, concorda com a nossa Política de Privacidade.

Siga-nos no Facebook

Veja notícias da empresa, notícias do mercado e muito mais!

Obrigado. Já sigo a vossa página!

Livro de Forex para principiantes

O seu grande guia no mundo do trading.

Confira a sua caixa de entrada!

Encontrará no nosso e-mail o Livro Básico de Forex. Basta tocar no botão para obtê-lo!

Alerta de risco: ᏟᖴᎠs são instrumentos complexos e vêm com um alto risco de perda rápida do dinheiro devido à alavancagem.

69,21% das contas de investidores de retalho perdem dinheiro ao negociar ᏟᖴᎠs com este provedor.

Deve considerar se entende como funcionam os ᏟᖴᎠs e se tem condições de assumir o alto risco de perder o seu dinheiro.

Informação não é consultoria em investimentos

Now traders follow the economic events with new vision as inflation in the US seems like decreasing. Let’s see what releases will influence the market due to that factor.

November 15, 15:30 GMT+2

The US Bureau of Labor Statistics will announce the Producer Price Index on Tuesday, November 15, at 15:30 GMT+2. It's a leading indicator of consumer inflation as producers' expenses are usually passed on to consumers. If results are lower than expected, it might mean that the inflation growth is slowing down. As a result, the Fed may conduct a more dovish monetary policy pushing the USD down.

As an example, we can look at the USDCAD chart. Since the beginning of November, the USD has been falling slowly. CPI release showed a decline in inflation, аnd the USDCAD lost almost 2400 points. PPI will prove it one more time.

Last time, the actual data exceeded expectations, 0.4% vs. 0.2% expected. It was the first increase in three months and showed an 8.5% gain from last year. Prices paid to US manufacturers rose more than expected in September, indicating that inflationary pressures will take time to ease and that the Federal Reserve will continue aggressive rate hikes.

Instruments to trade: EURUSD, USDCAD, GBPUSD.

November 16, 09:00 GMT+2

The UK Office of National Statistics will announce its Consumer Price Index on Wednesday, November 16, 09:00 GMT+3. It’s the indicator of the overall inflation.

Inflation in the UK reached a 40-year high of 10.1% in September, and economists expect further growth through the end of the year. The Bank of England has recently raised interest rates in the UK by 0.75 percentage point, the biggest increase in 30 years. A year ago, the interest rate was 0.1%. Today it is 3%.

The BoE raised interest rates due to inflation, trying to maintain price stability. Traditionally, this means keeping inflation around 2%. Sometimes inflation, of course, deviates from this target, and small short-term fluctuations are normal. However, inflation has been above the target since mid-2021 and is now at a 40-year high of around 10%.

Now the GBPUSD is recovering, slowly but surely climbing up.

Instruments to trade: GBPUSD, GBPCAD, EURGBP.

November 16, 15:30 GMT+2

The US will publish Retail Sales and Core Retail Sales on November 16 at 15:30 GMT+2. Both indicators demonstrate a change in the total value of sales at the retail level. Core Retail Sales differ from the primary indicator, as the former does not count automobile sales.

The retail data helps track consumer spending, which accounts for most of the overall economic activity. If the economic activity intensifies, the country's overall economic health improves. In the previous release, Retail Sales and Core Retail Sales were mixed, 0.0% vs. 0.2% expected and 0.1% vs. -0.1%, respectively. Inflation is slowing down, so this release will show how the fight against inflation goes.

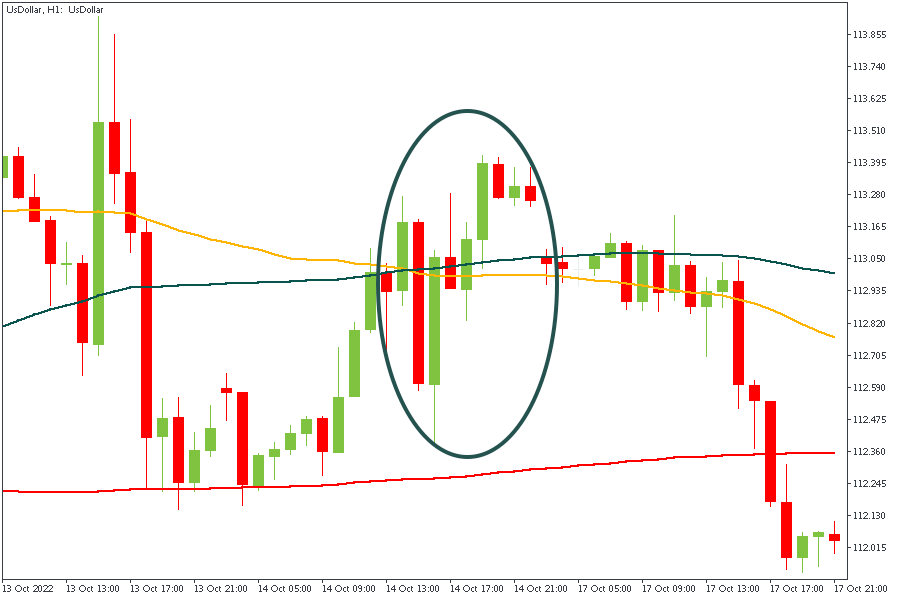

Last time, the release caused the fluctuations in the market. The US dollar index dipped down, and recovered quickly.

Instruments to trade: XAUUSD, EURUSD, USDCAD, USDCHF.

A Agência Australiana de Estatística vai anunciar os novos resultados da taxa de desemprego e da criação de empregos, na quinta-feira, 19 de maio, às 04:30 (MT).

O Escritório Nacional de Estatística do Reino Unido vai publicar a inflação no consumidor (índice CPI) na quarta-feira, 18 de maio, às 09:00 (MT).

A Agência do Censo dos EUA vai anunciar as vendas a retalho (totais e núcleo) na terça-feira, 17 de maio, às 15:30 (MT).

Discutiremos nesta análise as notícias importantes da semana. Quais notícias terão impacto no mercado financeiro? Como será a reação dos pares de moedas principais?

A Agência Australiana de Estatística vai anunciar os novos resultados da taxa de desemprego e da criação de empregos, na quinta-feira, 19 de maio, às 04:30 (MT).

O Escritório Nacional de Estatística do Reino Unido vai publicar a inflação no consumidor (índice CPI) na quarta-feira, 18 de maio, às 09:00 (MT).

Seu pedido foi aceito

Faremos contacto no intervalo de horário escolhido

O próximo pedido de contato para este número de telefone estará disponível em 00:30:00

Se tiver um problema urgente, por favor, contacte-nos via

Chat ao vivo

Erro interno. Por favor, tente novamente mais tarde