The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Join Us on Facebook

Stay on top of company updates, trading news, and so much more!

Thanks, I already follow your page!

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

72.12% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

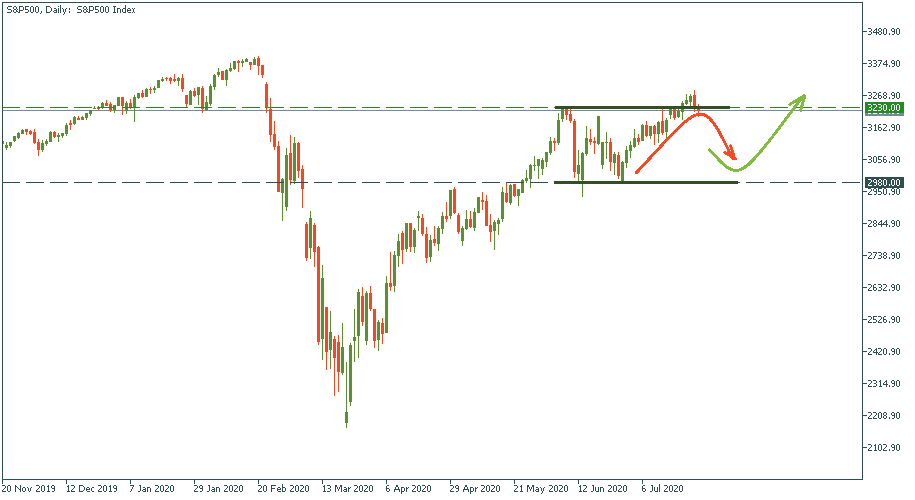

A month ago, we wrote an analysis forecasting the possible area of S&P’s movement. So far, it goes exactly as prescribed. The current trajectory lies in the upper layer of the Zone 1 as per that article. That zone was considered as the most probable and moderate movement area from the point of view at the end of June. But the question is, what lies ahead?

Going a bit more fundamental, we have to recognize the following: mostly, the latest bullish advance of the stock market was the result of the optimism of the tech sector. Hence, let’s see the tech sector.

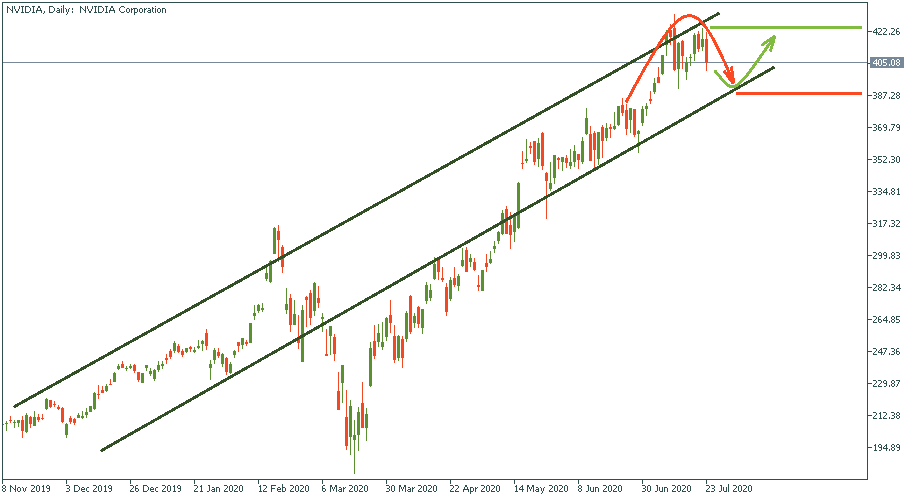

Nvidia is a strong performer. Not a star or giant like Tesla or Amazon (none of which is exclusively a tech company), but a really strong performer. Nvidia already found its way to fall into the pre-crisis trajectory as it is clearly visible at the daily chart below. And currently, a brief look suggests that it just bounced down after tipping above the upper border of the channel. Hence, we are in expectation of a downward correction – probably to the lower border of the channel. With the current dynamic, it will probably come down to the range of 390.

But that was the spearheading part of the stock market that contributed most fuel to its latest push. Noting that the other part consists of “weaker” stocks that are slower in recovery, let’s look at those.

Mastercard hasn’t reached the pre-virus trajectory yet. It has been in a large sideways channel during the last two months. Currently, it seems to bounce down from the upper border of that channel. In a nutshell, the disposition is very similar to that of Nvidia, but the latter one has an uptrend, while the former is going flat. Hence, some 10% dropdown seems to be coming. After that, probably a bounce upwards.

Now, knowing that the performance of the S&P is roughly an average between the bullish tech sector and sluggish remaining stocks, here is what we have with the S&P.

A trajectory slightly more recovered and bullish than that of Mastercard but way less aggressive than that of Nvidia. The dynamic is the same though: a channel, tipping above it, most probably a slide down, and then – expectedly – bounce upwards.

For this reason, yes, it makes sense to expect a dropdown in the stock market and the S&P in the coming days and possibly weeks. But that’s the main thing: it has been foreseen, and it is within a moderate and reasonable projection. In our previous review, we already mentioned than the current sideways period may be protracted horizontally and even last until there are firm victories over the virus in the US. For this reason, just keep patience: it is another night before the sun rises once again.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later