Leve queda nos Títulos do tesouro torna o USD menos atrativo

Não perca seu tempo. Acompanhe o impacto das NFP no dólar dos EUA!

Aviso de coleta de dados

Nós mantemos um registo dos seus dados para fazer funcionar este sítio web. Ao clicar no botão, concorda com a nossa Política de Privacidade.

Siga-nos no Facebook

Veja notícias da empresa, notícias do mercado e muito mais!

Obrigado. Já sigo a vossa página!

Livro de Forex para principiantes

O seu grande guia no mundo do trading.

Confira a sua caixa de entrada!

Encontrará no nosso e-mail o Livro Básico de Forex. Basta tocar no botão para obtê-lo!

Alerta de risco: ᏟᖴᎠs são instrumentos complexos e vêm com um alto risco de perda rápida do dinheiro devido à alavancagem.

69,21% das contas de investidores de retalho perdem dinheiro ao negociar ᏟᖴᎠs com este provedor.

Deve considerar se entende como funcionam os ᏟᖴᎠs e se tem condições de assumir o alto risco de perder o seu dinheiro.

Informação não é consultoria em investimentos

Investor confidence in the global financial system has been shaken by the collapse of Silicon Valley Bank and Credit Suisse. As a result, many are turning to bearer assets, such as gold and bitcoin, to store value outside of the system without relying on third parties. This has led to a surge in demand for physical gold bars and coins, with some investors even calling for hyperbitcoinisation. With a potential target of around $35,000, both gold and bitcoin may continue to increase in value. Hyperbitcoinisation is a hypothetical scenario in which Bitcoin is widely accepted by merchants and individuals alike, leading to its price rising dramatically and it becoming the dominant form of money in use.

How does this reflect on the Technical Analysis side of things? Let's see;

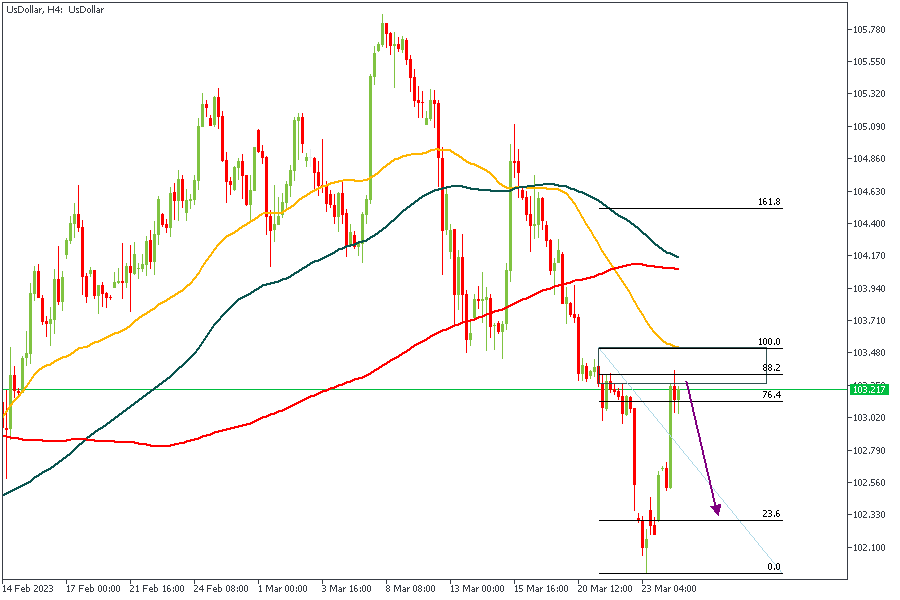

The US Dollar (DXY) after a long bearish run has commenced a move that can be considered as a retracement move; since it has not yet broken through any major price levels yet. This retracement has, however, reached the 88% of the Fibonacci retracement, and there is also the 50-period MA acting as a resistance. Should this play out and the Dollar indeed gets weaker, we can expect to see higher prices on Gold and Bitcoin as investor flock into these 'safe havens.'

Analysts’ Expectations:

Direction: Bearish

Target: 102.330

Invalidation: 103.600

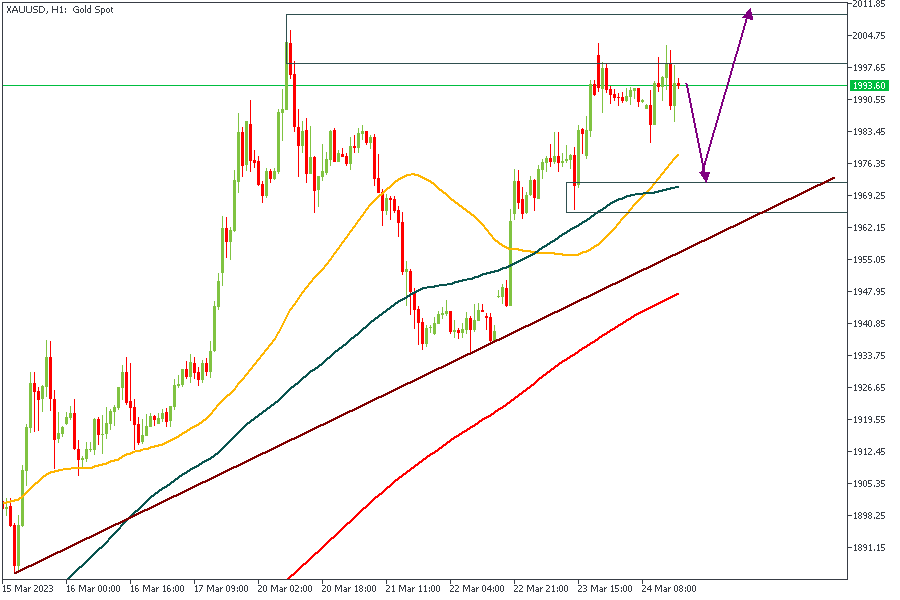

XAUUSD is currently stalking the supply zone at the $2004 price region. If price should be rejected from that zone, I have marked out the $1970 area as a point of interest where we may get to see Gold resume its bullish momentum. The presence of the 50 and 100 MAs is an added confirmation of the bullish intent.

Analysts’ Expectations:

Direction: Bullish

Target: $2011.00

Invalidation: $1962.70

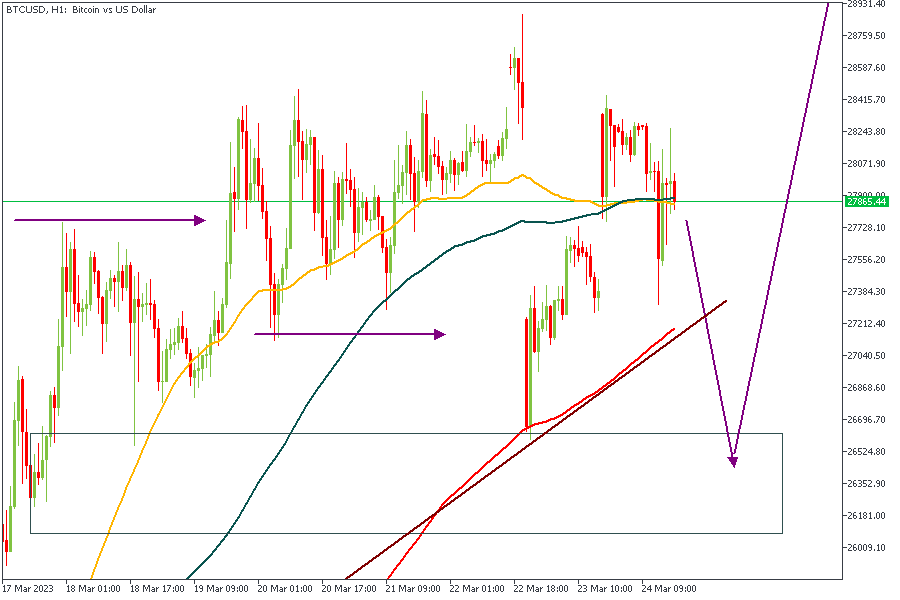

BTCUSD (Bitcoin) began a bull-run early this month and has since then maintained a strong bullish sentiment with very abrupt retracements. The current price action on Bitcoin suggests, however, that another retracement could occur - based on the attenuation around the 100 MA. My expectation is that Bitcoin dips slightly lower than the 200 MA and the trendline support, before resuming its bullish momentum.

Analysts’ Expectations:

Direction: Bearish

Target: $28,000

Invalidation: $26,000

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

Legal disclaimer: The content of this material is a marketing communication, and not independent investment advice or research. The material is provided as general market information and/or market commentary. Nothing in this material is or should be considered to be legal, financial, investment or other advice on which reliance should be placed. No opinion included in the material constitutes a recommendation by Tradestone Ltd or the author that any particular investment security, transaction or investment strategy is suitable for any specific person. All information is indicative and subject to change without notice and may be out of date at any given time. Neither Tradestone Ltd nor the author of this material shall be responsible for any loss you may incur, either directly or indirectly, arising from any investment based on any information contained herein. You should always seek independent advice suitable to your needs.

Leve queda nos Títulos do tesouro torna o USD menos atrativo

Expectativa agora está nas Declarações do FOMC

O recuo dos rendimentos dos títulos dos EUA pesou sobre o dólar

A pandemia continua a prejudicar a atividade económica na China, a guerra na Ucrânia continua a impactar a economia europeia inteira, e os esforços do Federal Reserve para controlar a inflação ameaçam provocar uma recessão.

Sempre que a inflação excede 4% e o desemprego vai abaixo de 5%, a economia dos EUA entra em recessão dentro de dois anos.

BCE dovish e Fed hawkish pintam uma paisagem pessimista para o EUR/USD. Será a próxima parada uma queda a 1,0770?

Seu pedido foi aceito

Faremos contacto no intervalo de horário escolhido

O próximo pedido de contato para este número de telefone estará disponível em 00:30:00

Se tiver um problema urgente, por favor, contacte-nos via

Chat ao vivo

Erro interno. Por favor, tente novamente mais tarde